1. General presentation

Avalanche is a next-generation blockchain developed by Ava Labs and launched in September 2020. Its main goal is to offer a super-fast, scalable and decentralized platform for decentralized applications (dApps), decentralized finance (DeFi) and digital assets.

Creator: Ava Labs, founded by Professor Emin Gün Sirer.

Consensus mechanism: Avalanche Protocol (variation of Proof-of-Stake).

Native token: AVAX, used for transaction fees, staking and governance.

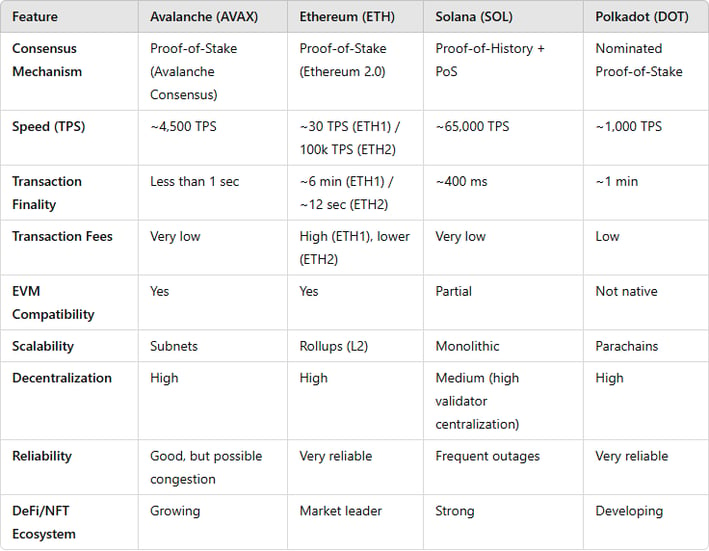

TPS (transactions per second): Up to 4,500 TPS, much faster than Bitcoin (7 TPS) and Ethereum (30 TPS).

Finalization time: Less than a second.

2. Architecture and technology

Avalanche is distinguished by a unique multi-chain architecture, composed of three main blockchains:

X-Chain (Exchange Chain): Used for the creation and exchange of digital assets.

C-Chain (Contract Chain): Compatible with EVM (Ethereum Virtual Machine), which allows Ethereum developers to easily migrate their dApps to Avalanche.

P-Chain (Platform Chain): Responsible for coordinating validators and managing subnets.

Subnets are a major innovation from Avalanche: they are personalized blockchains running on the Avalanche network, allowing great flexibility for DeFi/NFT companies and projects.

3. Benefits of Avalanche

✅ Scalability and Speed

Avalanche is capable of handling up to 4,500 transactions per second with near-instant finality, making it much more efficient than Ethereum.

✅ Low transaction fees

Gas fees on Avalanche are much lower than those on Ethereum, although they can vary depending on network usage.

✅ Compatibility with Ethereum (EVM)

Avalanche supports smart contracts written for Ethereum, making it easier for developers and projects to migrate from Ethereum.

✅ Decentralization and Security

Unlike other fast blockchains like Solana, Avalanche maintains a high level of decentralization with thousands of validators.

✅ Subnets

Allows companies and projects to create custom blockchains with their own rules and governance, without overloading the main chain.

✅ Economics of the AVAX token

Avalanche's tokenomics model is deflationary: all transaction fees are burned, reducing the supply of tokens over time.

4. Disadvantages of Avalanche

❌ Intense competition

Avalanche competes with Ethereum 2.0, Solana, Polkadot, and other fast blockchains like Aptos and Sui, making adoption more difficult.

❌ Relative centralization of staking

To become a validator on Avalanche, you must stake a minimum of 2,000 AVAX, which may limit the participation of small investors.

❌ Network reliability

Although more reliable than Solana, Avalanche has already experienced periods of congestion due to a massive influx of users.

❌ Adoption still in development

Even though Avalanche hosts several DeFi and NFT projects, it is still far from having the ecosystem of Ethereum in terms of applications and user volume.

Avalanche (AVAX)

5. Conclusion: Is Avalanche a good investment?

Avalanche is a very promising blockchain that combines scalability, EVM compatibility and low latency, making it a serious competitor to Ethereum. Its deflationary business model and subnets give it a unique advantage, particularly for companies looking to create their own blockchains.

However, despite its impressive performance, Avalanche faces strong competition and still needs to expand its adoption to establish itself sustainably. Its reliability is higher than that of Solana, but Ethereum remains the undisputed leader in terms of ecosystem.